Portuguese Primeira Liga Wagering Analysis 2025-2026

Predictions for Portuguese Liga Portugal football 2025-26

The Portuguese top division prepares for the 2025-26 campaign with compelling title race dynamics that attract strategic bettors worldwide. Platforms like Mostbet provide extensive wagering opportunities across all Portuguese league markets, from championship outcomes to cup competitions and individual player achievements, making this season particularly appealing for discerning punters. Market evaluations demonstrate authentic competitive balance between Lisbon’s powerhouse duo, establishing optimal conditions for thrilling championship battles and substantial betting value throughout the campaign.

New members at Mostbet can access bonus rewards of up to €400 to boost their sports predictions.

Championship Contender Assessment

Portugal’s title race framework reflects traditional national football hierarchy through Big Three dominance, yet features distinctive equality within the elite tier.

Portuguese Championship

Sporting Clube de Portugal (2.1) commands favorable market positioning through their systematic development philosophy and tactical model continuity. The Green Lions established sustainable operational frameworks independent of individual star power, emphasizing collective excellence and strategic discipline.

Sporting’s leadership foundation centers on harmoniously blending academy graduate development with intelligent transfer market acquisitions. This methodology ensures simultaneous financial stability and competitive prowess across multiple seasons.

Benfica (2.35) maintains minimal separation, creating maximally competitive championship scenarios. The Eagles prioritize squad rejuvenation and promising talent investments designed to secure extended dominance periods.

Benfica’s strategic approach leverages one of Europe’s premier youth development systems alongside selective international-caliber player acquisitions. This philosophy could deliver immediate dividends if emerging talents rapidly adapt to elite-level requirements.

Porto (5.5) occupies distinctly different odds territory, yet Portuguese football history contains numerous examples of Dragons creating pivotal moment sensations. The northerners traditionally excel during psychological confrontations with Lisbon giants.

Porto’s operational philosophy emphasizes tactical precision and maximum individual contribution levels. Despite reduced resources compared to rivals, they compensate through collective determination and innovative tactical problem-solving capabilities.

Braga (50) represents Portuguese football’s fourth power, though the elite gap remains substantial. The Minotaurs possess occasional brilliance capacity yet present no systematic Big Three threats.

Remaining championship participants carry 100+ odds, reflecting their tournament roles – survival battles and occasional upset attempts against prestigious opponents.

| Club | Mostbet |

|---|---|

| Sporting Clube de Portugal | 2.1 |

| Benfica | 2.35 |

| Porto | 5.5 |

| SC Braga | 50 |

| Estoril | 100 |

| Aves | 100 |

| Arouca | 100 |

| Moreirense | 100 |

| Vitoria Guimaraes | 100 |

| Nacional da Madeira | 100 |

| Gil Vicente | 100 |

| Rio Ave | 100 |

| Tondela | 100 |

| Santa Clara | 100 |

| Famalicao | 100 |

| Estrela da Amadora | 100 |

| Casa Pia | 100 |

| Alverca | 100 |

Championship Contender Assessment

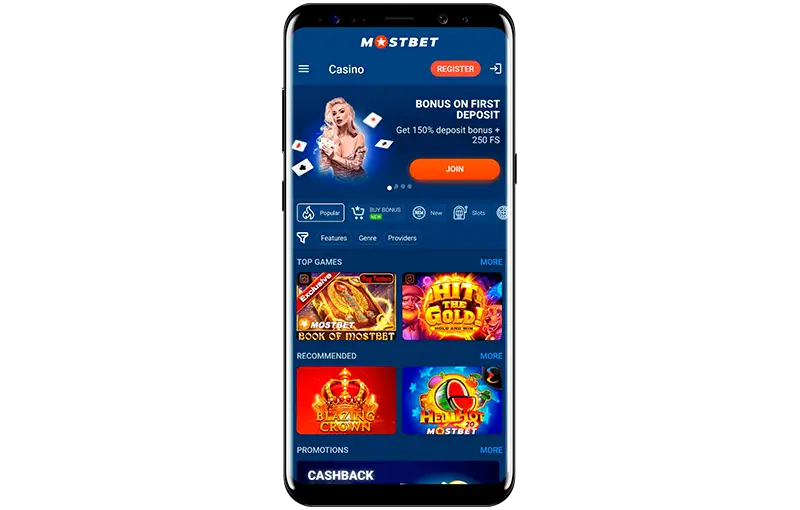

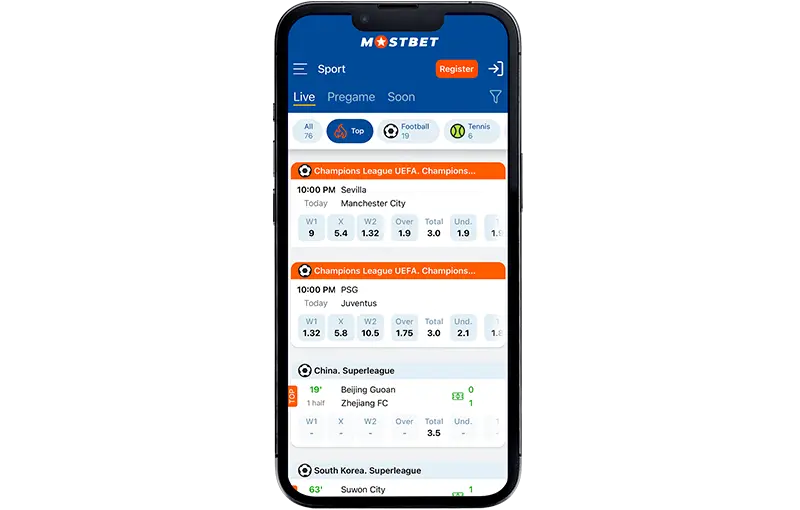

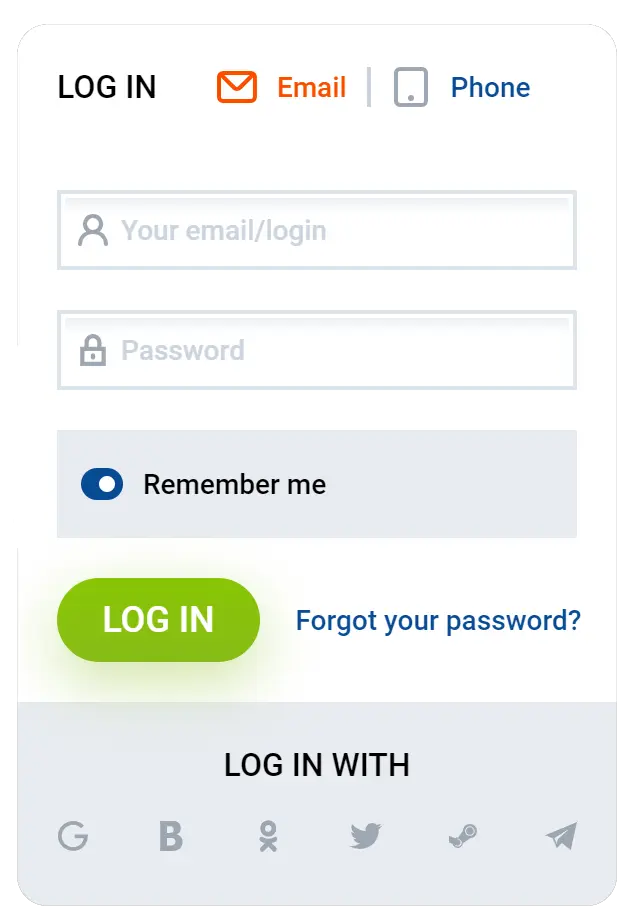

Mostbet Mobile Interface for Primeira Liga Betting

The Mostbet mobile interface offers advanced betting functionalities for Portuguese Primeira Liga matches and other elite European competitions. The platform ensures streamlined access to broad odds coverage and lightning-fast in-play betting through handheld devices.

Download Mostbet app

Android Installation

Deploying Mostbet on Android frameworks requires accessing the official website through your mobile browser, as Google Play Store distribution remains unavailable due to Google’s regulatory policies. Identify the mobile application download component or advertising banner on the homepage.

Choose the Android release and trigger the download mechanism. Before download initialization, your equipment may request authorization for installing programs from unofficial repositories. Enable this function in your security settings, as the program download transpires beyond Google’s sanctioned marketplace. Upon authorization completion, the Mostbet APK binary will initiate transfer. When transfer concludes, open the binary and adhere to the setup instructions presented, finalizing in seconds. The program becomes active for Primeira Liga wagering participation immediately after successful deployment.

iOS Installation

iPhone and iPad operators can deploy the Mostbet program through twin installation approaches. The fundamental method involves opening App Store directly, executing a “Mostbet” search, identifying the authentic program featuring the bookmaker’s official branding, and triggering “Install” with subsequent Face ID, Touch ID, or Apple ID verification procedures.

The supplementary approach requires browsing the official Mostbet website through your iOS browser, locating the download mechanisms in the primary navigation’s elevated section, triggering the iOS emblem, which delivers automatic redirection to the Mostbet App Store profile. Conclude deployment by triggering “Install” and providing verification as necessary. Both approaches establish the Mostbet program on your device desktop, enabling immediate Primeira Liga wagering access combined with additional football championships.

Champions League Qualification Markets

Portuguese championship’s top-two marketplace presents exceptional circumstances – authentic three-team competition for dual Champions League positions. Such competitive dynamics create remarkable opportunities for extended betting strategies.

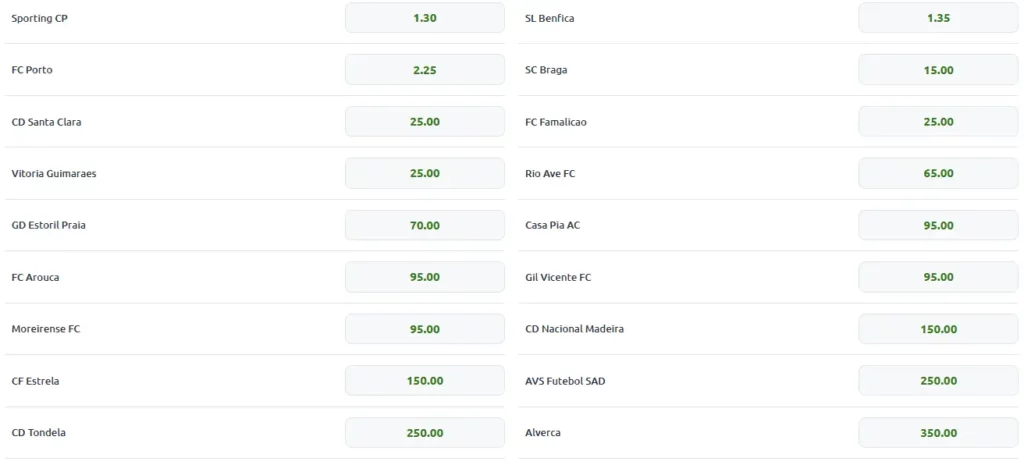

Sporting (1.30) maintains marginal odds advantages through recent seasonal result consistency. The Green Lions demonstrate reliability crucial for guaranteed European tournament participation.

Benfica (1.35) enjoys virtually identical top-two consideration, reflecting squad quality and young player potential. The Eagles possess sufficient roster depth for multi-front competition sustainability.

Critical intrigue concentrates around the third top-two participant. Porto (2.25) maintains realistic displacement opportunities against either Lisbon giant, rendering each direct confrontation decisive for final positioning.

Significantly, Braga (15.00) carries odds 6-7 times Porto’s levels, indicating qualitative chasms between the Big Three and remaining championship participants. The Minotaurs can target third-place maximums.

Secondary tier teams – Santa Clara, Vitoria Guimaraes, and Famalicao (all 25.00) – theoretically possess breakthrough season capabilities, yet their top-two prospects remain purely hypothetical.

| Club | Mostbet |

|---|---|

| Sporting CP | 1.30 |

| SL Benfica | 1.35 |

| FC Porto | 2.25 |

| SC Braga | 15.00 |

| CD Santa Clara | 25.00 |

| Vitoria Guimaraes | 25.00 |

| FC Famalicao | 25.00 |

| Rio Ave FC | 65.00 |

| CD Estoril Praia | 70.00 |

| Casa Pia AC | 95.00 |

| FC Arouca | 95.00 |

| Gil Vicente FC | 95.00 |

| Moreirense FC | 95.00 |

| CD Nacional Madeira | 150.00 |

| CF Estrela | 150.00 |

| CD Tondela | 250.00 |

| AVS Futebol SAD | 250.00 |

| Alverca | 350.00 |

Champions League Qualification Markets

Portuguese Cup Championship Analysis

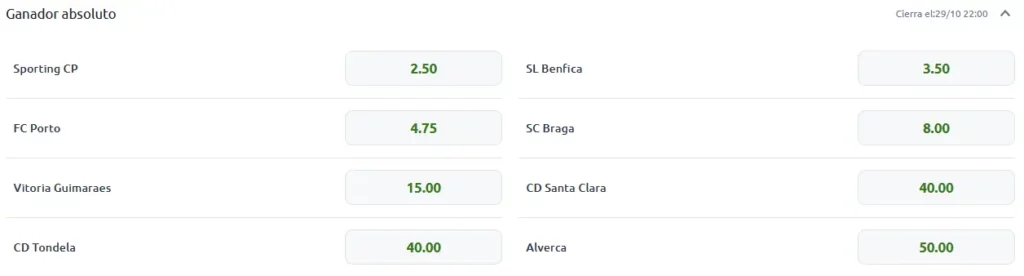

Sporting (2.50) leads cup tournament favoritism, logically considering their league status and squad depth advantages. The Green Lions approach national cup competitions seriously as additional trophy opportunities.

Benfica (3.50) represents primary Sporting cup race competition. The Eagles maintain distinguished tournament traditions while frequently utilizing cup fixtures for young talent first-team integration.

Porto (4.75) potentially offers optimal value among established favorites. Cup format environments emphasize psychological factors significantly, with Dragons traditionally excelling during decisive encounters against higher-rated opposition.

Braga (8.00) consistently reaches advanced tournament stages and possesses capabilities for troubling any giant through single-match scenarios. The Minotaurs’ underdog mentality can provide competitive advantages.

| Club | Mostbet |

|---|---|

| Sporting CP | 2.50 |

| SL Benfica | 3.50 |

| FC Porto | 4.75 |

| SC Braga | 8.00 |

| Vitoria Guimaraes | 15.00 |

| CD Santa Clara | 40.00 |

| CD Tondela | 40.00 |

| Alverca | 50.00 |

Portuguese Cup Championship Analysis

Transfer Window Impact Evaluation

Portuguese football’s 2025 transfer period emphasized strategic planning across all Big Three representatives. Each organization selected distinct development pathways, creating unique competitive approach combinations.

Porto: Tactical Evolution

Porto undertook comprehensive squad modernization, combining experienced professional acquisitions with promising player investments.

Viktor Frihöldt introduced Scandinavian work ethics to midfield sectors, while Gabri Veiga contributed Spanish technical qualities to attacking frameworks. Alberto Costa and Nehuén Pérez reinforced defensive lines through international experience.

Borja Sainz and Jan Bedranek established quality midfield competition, while Dominik Pryč and João Costa represent extended investment horizons.

Substantial departures included Francisco Conceição, Otávio, João Mário, Gonçalo Borges, Fran Navarro, and Iván Marcano. Conceição and Otávio exits particularly weakened attacking potential.

Numerous newcomer integration requirements while losing experienced leadership explains Porto’s relatively elevated odds positioning.

Pau Victor Braga

Sporting: International Development Strategy

Sporting executed ambitious global recruitment programs, attracting talents from diverse football cultures. The Lisbon Lions demonstrated international transfer market competitive capabilities.

Luis Suárez emerged as central midfield stabilization acquisition. The experienced midfielder contributes international performance standards and leadership qualities essential for championship aspirations.

Georgi Kochorashvili reinforced defensive structures through European experience, while Rui Silva enhanced attacking versatility. Alisson Santos represents South American creative midfield traditions.

Prospective acquisitions João Virgínia and Diogo Trivaldos demonstrate extended planning horizons and young talent development confidence.

Departures proved equally significant: Viktor Gyökeres, Dário Essugo, Marcus Edwards, Franco Israel, and Vladan Kovačević left the organization. Gyökeres’ loss particularly impacted attacking construction – the Swedish marksman served as key offensive focal point.

Financial equilibrium remained positive through strategic sales, enabling quality reinforcement reinvestment without compromising organizational stability.

Benfica: Generational Transformation

Benfica selected radical squad rejuvenation strategies, investing in players destined to define club identity throughout the next decade.

Richard Rios became crucial creative midfield acquisition, contributing Colombian technical excellence and contemporary positional play understanding. Amar Dedić strengthened right defensive flanks through Balkan reliability.

Samuel Dahl and Rafa Obrador represent foundational team investments – defensive stability forming serious project cornerstones.

Departures included notable Ángel Di María loss – the Argentine maestro symbolized creativity and experience. Álvaro Carreras, Arthur Cabral, Casper Tengstedt, João Mário, Sevalino Menze, and Martim Neto similarly departed.

Rejuvenation strategies may yield extended benefits, yet short-term adaptation risks reflect in bookmaker evaluations.

Braga: Pragmatic Stability

Braga operated within financial limitations, emphasizing targeted reinforcements without revolutionary modifications.

Pau Víctor contributed Spanish midfield technique, while Mario Douglas introduced South American creativity. Fran Navarro, Gustaf Lagerbielke, and Aleš Belařuš reinforced various positions through international experience.

Leonardo Lelo and Djibril Soumaré enhanced squad depth without dramatic tactical philosophy alterations.

Minimal departures included Roberto Fernández, Mateus, and José Mendes – enabling project stability maintenance while incorporating quality improvements.

\

Gabriel Veiga Porto

Competitive Balance Implications

Transfer movements confirmed and amplified existing hierarchical structures:

- Sporting reinforced leadership positions through balanced development strategies

- Benfica emphasized future potential while accepting short-term adaptation risks

- Porto modernized rosters yet requires newcomer integration time

- Braga maintained stability though elite gaps expanded

These developments fully manifest in bookmaker configurations, establishing foundations for contemporary Portuguese football’s most compelling campaigns.