German Bundesliga Wagering Guide 2025-2026

Predictions for German Bundesliga football 2025-26

The German football landscape enters the 2025-26 campaign with betting platforms like Mostbet providing extensive wagering opportunities across all Bundesliga markets – from championship outcomes to individual player performances. This season presents an extraordinary scenario of single-club dominance unprecedented in modern German football history, creating unique betting dynamics that savvy punters can exploit throughout the campaign.

Bayern Munich’s restoration to absolute supremacy following their temporary setback has fundamentally altered the competitive balance. Market analysis reveals Munich’s unparalleled dominance with title odds of just 1.30-1.33 – among the shortest prices ever recorded for a major European league champion. This bookmaker confidence stems from comprehensive organizational restructuring and the club’s return to its traditional winning philosophy.

Sports enthusiasts can unlock up to €400 in bonus credits through Mostbet’s welcome package.

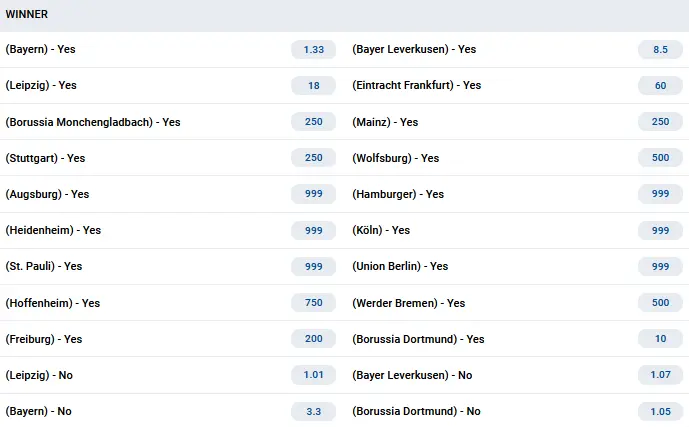

Title Race Market Analysis

The German championship betting landscape has transformed into something not witnessed since Bayern’s early 2010s hegemony. Bookmakers essentially eliminate upset possibilities, treating Munich’s title triumph as mathematical certainty.

Bundesliga 25-26

Bayern Munich commands extraordinary market confidence with odds spanning 1.30-1.33, representing overwhelming superiority over all challengers. Such compressed pricing rarely appears in elite competitions, reflecting fundamental club reconstruction under refreshed leadership. The revival of traditional Bavarian values – tactical discipline, systematic preparation, and ruthless execution – has restored rival teams’ psychological intimidation.

The chasm separating Munich from nearest challengers reaches remarkable proportions. Bayer Leverkusen (7.2-8.5) faces distant outsider status despite recent accomplishments. The pharmaceutical giants suffered core squad and coaching departures, prompting bookmaker pessimism regarding their competitive capacity against Bayern’s machine.

Borussia Dortmund (9.2-11.0) traditionally represents Munich’s primary challenger, yet current odds demonstrate this rivalry era’s conclusion. The Yellow Wall’s chronic inconsistency in pressure situations and key player losses created an unbridgeable gap with the Bavarian leaders.

RB Leipzig (15.5-18.0) completes the theoretical title contender group. The Red Bulls possess resources and ambition, but their pricing reflects harsh reality – they compete not for championships but for recognition as Germany’s second-best team.

Remaining clubs hold purely ceremonial chances. Eintracht Frankfurt (43-60) and Freiburg (100-200) occupy mid-table expectations without serious ambitions, highlighting German football’s competitive depth crisis.

| Club | Mostbet |

|---|---|

| Bayern Munich | 1.33 |

| Bayer 04 Leverkusen | 8.5 |

| Borussia Dortmund | 10 |

| RB Leipzig | 18 |

| Eintracht Frankfurt | 60 |

| Sport-Club Freiburg | 200 |

| Borussia Monchengladbach | 250 |

| FSV Mainz | 250 |

| SV Werder Bremen | 500 |

| Vfb Stuttgart | 250 |

| Vfl Wolfsburg | 500 |

| TSG 1899 Hoffenheim | 750 |

| Union Berlin | 999 |

| 1. FC Koln | 999 |

| FC Augsburg | 999 |

| Hamburger SV | 999 |

| 1. FC Heidenheim 1846 | 999 |

| FC St. Pauli | 999 |

Title Race Market Analysis

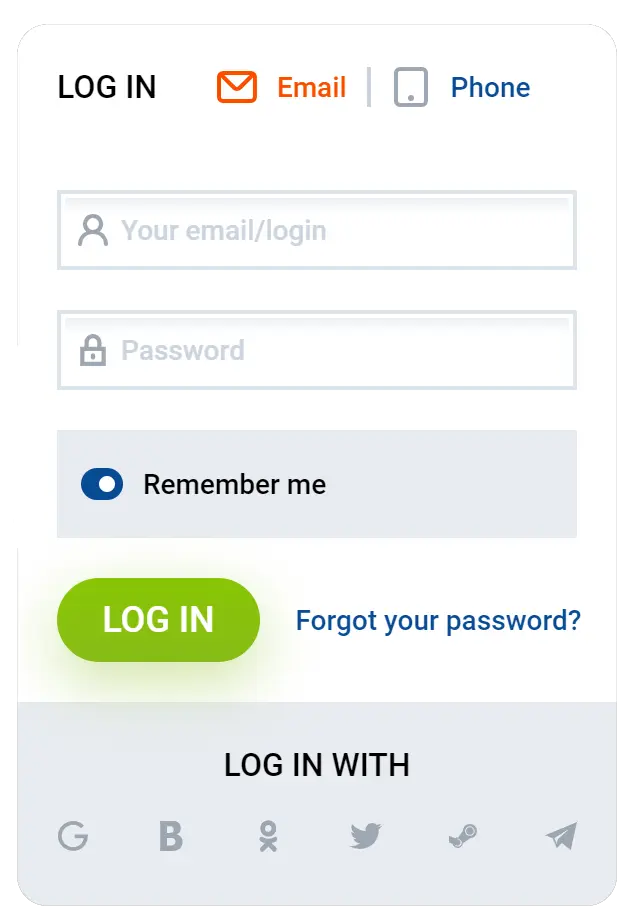

Mostbet Mobile Platform for Bundesliga Betting

The Mostbet mobile platform delivers exceptional betting capabilities for German Bundesliga fixtures and other premier European championships. The application guarantees smooth navigation through diverse betting options and instant live betting features from your smartphone or tablet.

Mostbet app

Android Installation

Setting up Mostbet on Android begins with accessing the official website through your mobile browser, since Google Play Store doesn’t host the application due to platform policies. On the main page, identify the mobile application download button or promotional banner.

Choose the Android edition and press the download selection. Your device might prompt for authorization to install applications from external sources before download initiation. Enable this feature in your security configurations, as the application originates from outside Google’s official marketplace. Following authorization approval, the Mostbet APK package will commence downloading. Upon completion, launch the file and proceed with the guided installation steps, requiring mere seconds to finish. The application becomes available for Bundesliga wagering activities immediately upon successful setup.

iOS Installation

Apple device users can establish the Mostbet application via dual installation pathways. The primary method involves launching App Store directly, conducting a “Mostbet” search, identifying the authentic application bearing the bookmaker’s official logo, and selecting “Install” with subsequent Face ID, Touch ID, or Apple ID credential verification.

The secondary route requires browsing the official Mostbet website through your iOS browser, finding the download options in the primary menu’s top area, selecting the iOS symbol, which automatically redirects to the Mostbet App Store listing. Finalize installation by selecting “Install” and providing confirmation as needed. Both approaches position the Mostbet application on your device interface, enabling direct Bundesliga betting access alongside additional football competitions.

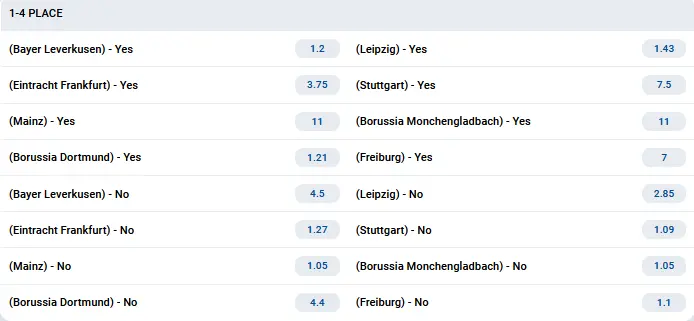

Champions League Qualification Markets

The German top-four marketplace presents even starker inequality illustrations. Bayern receives technical 1.002 odds, essentially guaranteeing Champions League participation with mathematical certainty.

Bayer Leverkusen (1.12-1.42) and Borussia Dortmund (1.19-1.42) enjoy virtual top-four guarantees. Such minimal pricing reflects the qualitative chasm between the leading triumvirate and remaining league participants.

RB Leipzig (1.45-3.1) maintains strong prospects, though odds variation across platforms suggests uncertainty regarding the Saxon outfit’s consistency levels.

Genuine competition emerges in fourth-place battles. Eintracht Frankfurt (3.75-6.5) leads contender rankings through European experience and squad quality. Frankfurt’s traditional home strength enables them to challenge any opponent effectively.

Freiburg (7-17) and Stuttgart (5.5-17) represent German football’s emerging generation, emphasizing youth development and contemporary tactical approaches. Significant odds spreads indicate varying assessments of their ceiling potential.

| Club | Mostbet |

|---|---|

| FC Bayern Munich | 1.002 |

| Bayer 04 Leverkusen | 1.12 |

| Borussia Dortmund | 1.20 |

| RB Leipzig | 1.80 |

| Eintracht Frankfurt | 4.00 |

| Sport-Club Freiburg | 8.00 |

| Vfb Stuttgart | 5.50 |

| Borussia Monchengladbach | 15.00 |

| FSV Mainz | 15.00 |

| TSG 1899 Hoffenheim | 15.00 |

| Vfl Wolfsburg | 15.00 |

| 1. FC Koln | 17.00 |

| Hamburger SV | 21.00 |

| FC Augsburg | 26.00 |

| Union Berlin | 51.00 |

| FC St. Pauli | 67.00 |

| 1. FC Heidenheim 1846 | 81.00 |

Champions League Qualification Markets

Relegation Battle Analysis

German championship survival warfare promises the season’s most compelling storylines. Historical clubs’ elite returns create precarious lower-table situations.

Four primary relegation candidates share identical 2.4 odds – Hamburg, Cologne, St. Pauli, and Heidenheim. This pricing equality reflects comparable challenges across all four: restricted budgets, squad instability, and absent tactical identity.

Hamburg represents the most symbolic relegation case. This former powerhouse – historically the only club participating in every Bundesliga season until recently – now battles elite survival following extended absence. Return campaigns carry enormous risks for previously successful organizations.

St. Pauli embodies German football romanticism, yet sentiment rarely aids harsh Bundesliga survival battles. The Hamburg-based club possesses unique atmosphere but limited financial resources for competitive squad building.

Heidenheim exemplifies teams where Bundesliga participation represents ultimate achievement. Modest budgets and elite inexperience make them natural demotion candidates.

Augsburg (5.5) and Union Berlin (6.0) occupy elevated risk categories. The Bavarians traditionally operate near danger zones, while Berlin experiences crisis following several successful campaigns.

| Club | Mostbet |

|---|---|

| Hamburger SV | 2.4 |

| 1. FC Koln | 2.4 |

| FC St. Pauli | 2.4 |

| 1. FC Heidenheim 1846 | 2.4 |

| FC Augsburg | 5.5 |

| Union Berlin | 6 |

| TSG 1899 Hoffenheim | 11 |

Relegation Battle Analysis

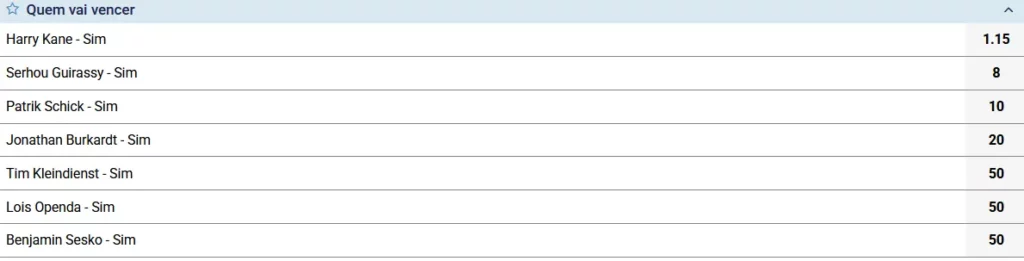

Leading Goalscorer Markets

The German championship’s top scorer marketplace showcases one player’s absolute supremacy. Harry Kane commands 1.15 odds, virtually guaranteeing seasonal scoring championship.

Bayern’s English marksman adapted to German football with phenomenal speed, displaying record-breaking productivity during his inaugural campaign. His positioning intelligence, clinical finishing, and ability to manufacture scoring opportunities from minimal chances render him untouchable among competitors.

The gap with closest challenger spans nearly seven-fold. Serhou Guirassy (8.0) occupies distant outsider status despite proven qualities and previous seasonal productivity.

Patrik Schick (10.0) from Bayer possesses theoretical opportunities, though his odds reflect concerns about the Czech striker’s full-season consistency.

Jonathan Burkardt (20.0) presents intriguing value for speculative wagering. The German Mainz striker possesses breakthrough qualities, with elevated odds potentially reflecting bookmaker underestimation of his capabilities.

The 50.0 odds group – Tim Kleindienst, Lois Openda, and Benjamin Sesko – represents emerging striker talent capable of surprise performances under favorable circumstances.

Kane’s dominance appears so definitive that bookmakers essentially transformed this market into procedural formality, leaving minimal space for alternative scenarios.

| Player | Mostbet |

|---|---|

| Harry Kane | 1.15 |

| Serhou Guirassy | 8 |

| Patrik Schick | 10 |

| Jonathan Burkardt | 20 |

| Tim Kleindienst | 50 |

| Lois Openda | 50 |

| Benjamin Sesko | 50 |

Leading Goalscorer Markets

Transfer Window Impact Analysis

The 2025 German football transfer period unfolded under power balance transformation signs. Liverpool conducted systematic Bundesliga raids, acquiring key talents from leading clubs, dramatically altering German championship equilibrium and explaining current betting configurations.

Bayern Munich: Strategic Quality Enhancement

Bayern prepares for summer’s most significant acquisitions. Luis Diaz should complete his Liverpool transfer for approximately €70 million, representing Munich’s transfer market re-engagement following economical periods.

The Colombian winger perfectly suits Bayern’s tactical framework, contributing pace and attacking unpredictability. His Premier League and Champions League experience makes this strategically crucial for Munich’s continental ambitions.

Jonathan Tah arrived as Bayer’s free agent, with €2 million additional compensation for Club World Cup participation. The 29-year-old German defender addresses central defensive depth concerns through valuable international experience.

These additions justify technical 1.30-1.33 championship odds – Bayern not only preserved their foundation but enhanced crucial positions.

Luis Diaz in Bayern

Eintracht Frankfurt: Unexpected Windfall

Eintracht emerged among transfer window’s primary beneficiaries, selling Hugo Ekitike to Liverpool for €95 million. The French striker spent only one Frankfurt season, yet his productivity attracted English giant attention.

This transaction dramatically improved the club’s financial position, enabling squad reinforcement in alternative positions. However, losing their primary striker may negatively impact team performance.

Borussia Dortmund and RB Leipzig: Stability Through Change

Dortmund and Leipzig navigated the transfer period relatively peacefully, avoiding key player losses while making targeted youth investments.

The Black and Yellows retained their squad foundation, crucial for consistent results. Borussia continues traditional young talent investment policies, spending €57.25 million on promising prospects.

Jobe Bellingham (€30.50 million) represents the standout acquisition. The 19-year-old Jude’s brother from Sunderland should continue family Dortmund traditions. Such investment in youth demonstrates confidence in his potential.

The Red Bulls maintained their global promising player investment approach. Jan Thanda (€20 million) from Leganes and Arthur Vermeeren (€20 million) from Atletico Madrid represent two key signings spanning different continents and playing styles.

Ezechiel Banzuzi (€16 million) from Belgian Leuven demonstrates scouting excellence in smaller championships.

Bayer Leverkusen: Critical Personnel Losses

Bayer endured catastrophic summer exodus, losing two cornerstone players plus head coach. Florian Wirtz departed to Liverpool for €125 million – German football’s record fee – though losing the 22-year-old prodigy proves irreplaceable for the pharmaceutical giants.

Jeremie Frimpong similarly joined Liverpool, depriving the team of Europe’s premier right-backs. The Dutch international served as Bayer’s attacking blueprint centerpiece.

Coaching transition compounded the crisis – Xabi Alonso transferred to Real Madrid, replaced by Erik ten Hag. The Dutch specialist confronts rebuilding challenges following key departures and tactical philosophy shifts.

These departures explain Bayer’s dramatic odds increase to 7.2-8.5 for title contention – bookmakers perceive minimal chances for the weakened squad competing against strengthened Bayern.

Malik Tillman Bayer Leverkusen

Power Balance Consequences

Transfer movements dramatically restructured Bundesliga equilibrium:

- Bayern enhanced quality significantly, becoming increasingly unreachable (1.30 odds)

- Bayer lost fundamental figures, retreating from championship contention

- Liverpool essentially weakened Bayern’s primary competitors through leader acquisitions

- The leader-chaser gap expanded critically

These developments explain current betting configurations and render the upcoming season the least competitive in modern Bundesliga history.